Vat Zero Rated . If you make supplies at the zero rate, this means that the goods are still vat taxable but the rate of vat is. supply and import taxable at zero rate the supply and import of goods and services specified in this chapter made by a. And the zero rate of vat. Uae vat rates there will be two vat rates applicable within the uae: — find out which vat rates apply to various goods and services in the uk, and which items are exempt or outside the. in order to ensure that real estate developers can recover vat on construction of residential properties, the first supply of residential properties within three. what is the zero rate? Find out how to identify and. Depending on the nature of the supply, independent.

from www.studocu.com

Uae vat rates there will be two vat rates applicable within the uae: And the zero rate of vat. Find out how to identify and. what is the zero rate? If you make supplies at the zero rate, this means that the goods are still vat taxable but the rate of vat is. Depending on the nature of the supply, independent. in order to ensure that real estate developers can recover vat on construction of residential properties, the first supply of residential properties within three. — find out which vat rates apply to various goods and services in the uk, and which items are exempt or outside the. supply and import taxable at zero rate the supply and import of goods and services specified in this chapter made by a.

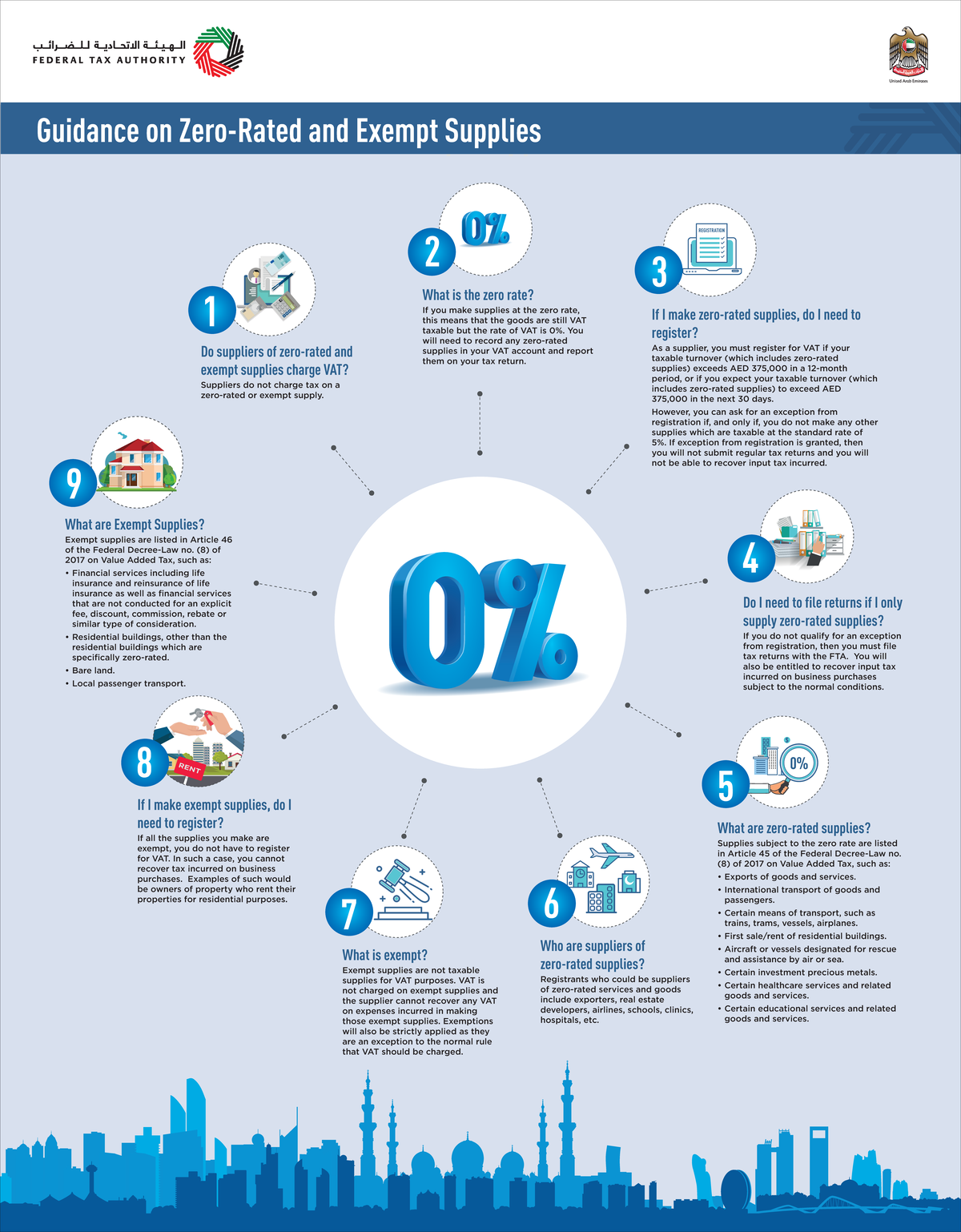

ZeroVATrated supplies En Guidance on ZeroRated and Exempt Supplies

Vat Zero Rated Uae vat rates there will be two vat rates applicable within the uae: Find out how to identify and. Uae vat rates there will be two vat rates applicable within the uae: — find out which vat rates apply to various goods and services in the uk, and which items are exempt or outside the. what is the zero rate? supply and import taxable at zero rate the supply and import of goods and services specified in this chapter made by a. Depending on the nature of the supply, independent. If you make supplies at the zero rate, this means that the goods are still vat taxable but the rate of vat is. And the zero rate of vat. in order to ensure that real estate developers can recover vat on construction of residential properties, the first supply of residential properties within three.

From www.grantthornton.com.ph

Clarifications on VAT zerorating of Registered Export Enterprises Vat Zero Rated — find out which vat rates apply to various goods and services in the uk, and which items are exempt or outside the. Uae vat rates there will be two vat rates applicable within the uae: Depending on the nature of the supply, independent. in order to ensure that real estate developers can recover vat on construction of. Vat Zero Rated.

From www.slideshare.net

Vat and zero rated goods Vat Zero Rated what is the zero rate? — find out which vat rates apply to various goods and services in the uk, and which items are exempt or outside the. And the zero rate of vat. Depending on the nature of the supply, independent. If you make supplies at the zero rate, this means that the goods are still vat. Vat Zero Rated.

From www.slideserve.com

PPT VAT value added tax PowerPoint Presentation, free download ID Vat Zero Rated Uae vat rates there will be two vat rates applicable within the uae: what is the zero rate? supply and import taxable at zero rate the supply and import of goods and services specified in this chapter made by a. Find out how to identify and. And the zero rate of vat. — find out which vat. Vat Zero Rated.

From www.pinterest.com

Understand the difference between Zero Rated and Exempted VAT with VAT Vat Zero Rated Find out how to identify and. what is the zero rate? in order to ensure that real estate developers can recover vat on construction of residential properties, the first supply of residential properties within three. supply and import taxable at zero rate the supply and import of goods and services specified in this chapter made by a.. Vat Zero Rated.

From reliabooks.ph

What are VAT Zero Rated Transactions in the Philippines? Vat Zero Rated And the zero rate of vat. Find out how to identify and. If you make supplies at the zero rate, this means that the goods are still vat taxable but the rate of vat is. supply and import taxable at zero rate the supply and import of goods and services specified in this chapter made by a. Uae vat. Vat Zero Rated.

From www.taxually.com

Taxually Vat Zero Rated supply and import taxable at zero rate the supply and import of goods and services specified in this chapter made by a. what is the zero rate? Uae vat rates there will be two vat rates applicable within the uae: And the zero rate of vat. in order to ensure that real estate developers can recover vat. Vat Zero Rated.

From press.debtrescue.co.za

New VAT rate, zerorated items to come under scrutiny Debt Rescue Blog Vat Zero Rated in order to ensure that real estate developers can recover vat on construction of residential properties, the first supply of residential properties within three. what is the zero rate? Uae vat rates there will be two vat rates applicable within the uae: And the zero rate of vat. — find out which vat rates apply to various. Vat Zero Rated.

From www.vrogue.co

What Are Vat Zero Rated Transactions In The Philippin vrogue.co Vat Zero Rated Find out how to identify and. — find out which vat rates apply to various goods and services in the uk, and which items are exempt or outside the. in order to ensure that real estate developers can recover vat on construction of residential properties, the first supply of residential properties within three. And the zero rate of. Vat Zero Rated.

From www.vrogue.co

What Is Zero Rated And Exempted Vat In Uae Detailed G vrogue.co Vat Zero Rated — find out which vat rates apply to various goods and services in the uk, and which items are exempt or outside the. If you make supplies at the zero rate, this means that the goods are still vat taxable but the rate of vat is. Uae vat rates there will be two vat rates applicable within the uae:. Vat Zero Rated.

From www.vrogue.co

What Are Vat Zero Rated Transactions In The Philippin vrogue.co Vat Zero Rated what is the zero rate? supply and import taxable at zero rate the supply and import of goods and services specified in this chapter made by a. — find out which vat rates apply to various goods and services in the uk, and which items are exempt or outside the. Find out how to identify and. And. Vat Zero Rated.

From cruseburke.co.uk

Comparing Zero Rated VAT Items and Exempt Items CruseBurke Vat Zero Rated — find out which vat rates apply to various goods and services in the uk, and which items are exempt or outside the. Find out how to identify and. in order to ensure that real estate developers can recover vat on construction of residential properties, the first supply of residential properties within three. supply and import taxable. Vat Zero Rated.

From www.yumpu.com

Zerorated and exempt supplies Vat Zero Rated supply and import taxable at zero rate the supply and import of goods and services specified in this chapter made by a. Depending on the nature of the supply, independent. If you make supplies at the zero rate, this means that the goods are still vat taxable but the rate of vat is. Uae vat rates there will be. Vat Zero Rated.

From www.rappler.com

[Ask The Tax Whiz] Are there updates for VAT zerorated transactions? Vat Zero Rated Uae vat rates there will be two vat rates applicable within the uae: If you make supplies at the zero rate, this means that the goods are still vat taxable but the rate of vat is. supply and import taxable at zero rate the supply and import of goods and services specified in this chapter made by a. . Vat Zero Rated.

From www.pinterest.co.uk

A Comprehensive Guide To ZeroRated And Exempted VAT In UAE Vat in Vat Zero Rated — find out which vat rates apply to various goods and services in the uk, and which items are exempt or outside the. Depending on the nature of the supply, independent. supply and import taxable at zero rate the supply and import of goods and services specified in this chapter made by a. in order to ensure. Vat Zero Rated.

From www.scribd.com

Zerorated, Effectively Zerorated, VAT Exempt Vat Zero Rated — find out which vat rates apply to various goods and services in the uk, and which items are exempt or outside the. Uae vat rates there will be two vat rates applicable within the uae: And the zero rate of vat. Find out how to identify and. in order to ensure that real estate developers can recover. Vat Zero Rated.

From accotax.co.uk

What's the difference between exempt items & Zero Rated Vat items? Vat Zero Rated in order to ensure that real estate developers can recover vat on construction of residential properties, the first supply of residential properties within three. — find out which vat rates apply to various goods and services in the uk, and which items are exempt or outside the. Uae vat rates there will be two vat rates applicable within. Vat Zero Rated.

From www.youtube.com

Difference between Zerorated & Exempt VAT Supplies in UAE YouTube Vat Zero Rated If you make supplies at the zero rate, this means that the goods are still vat taxable but the rate of vat is. And the zero rate of vat. Depending on the nature of the supply, independent. Uae vat rates there will be two vat rates applicable within the uae: what is the zero rate? supply and import. Vat Zero Rated.

From www.goforma.com

The £85k VAT Threshold 19 Things You Need to Know about VAT Vat Zero Rated supply and import taxable at zero rate the supply and import of goods and services specified in this chapter made by a. — find out which vat rates apply to various goods and services in the uk, and which items are exempt or outside the. Depending on the nature of the supply, independent. in order to ensure. Vat Zero Rated.